The Financial Secrecy Index thoroughly evaluates each jurisdiction’s financial and legal systems to identify the world’s biggest suppliers of financial secrecy. The index spotlights the laws and policies that governments can change to reduce their contribution to financial secrecy.

Financial secrecy facilitates tax abuse, enables money laundering and undermines the human rights of all. All jurisdictions have a responsibility to reduce their contribution to financial secrecy, big or small.

An overview of the Financial Secrecy Index’s methodology is provided below.

Findings are shared with ranked jurisdictions in advance

Every jurisdiction ranked on the index is given two opportunities during the research process, before the index is published, to feedback on and dispute the index’s assessment of their financial and legal systems. We share our findings with every ranked jurisdiction early on in the research process when our preliminary assessment is first prepared and again when our final assessment is completed at the end of the process. If a jurisdiction provides sufficient evidence that counters an assessment made by the index, the assessment is changed to reflect the evidence.

How we collect data

The research process involves collating a database of evidence-based evaluations. The database is a result of over a year of desk-based research by a dedicated team, and by numerous researchers around the globe. The cut-off date for the 2022 edition of the index is 30 September 2021, after which changes in regulations are not guaranteed to be included in the jurisdiction’s evaluation for the 2022 edition of the index. For some indicators, more recent data has been included. All jurisdictions ranked on the index had up to January 2022 to provide evidenced feedback or new information that may alter their assessment on the index.

The database covers information on the legal, administrative, regulatory, and financial structures of jurisdictions. The main data sources are official and public reports by the OECD and its associated Global Forum, the Financial Action Task Force (FATF), the IMF and the EU. Specialist tax databases and websites such as those by the IBFD, the “Big Four” accounting firms, and others have been consulted. Data was also sourced where needed through original investigative research and legal analysis.

How jurisdictions are ranked

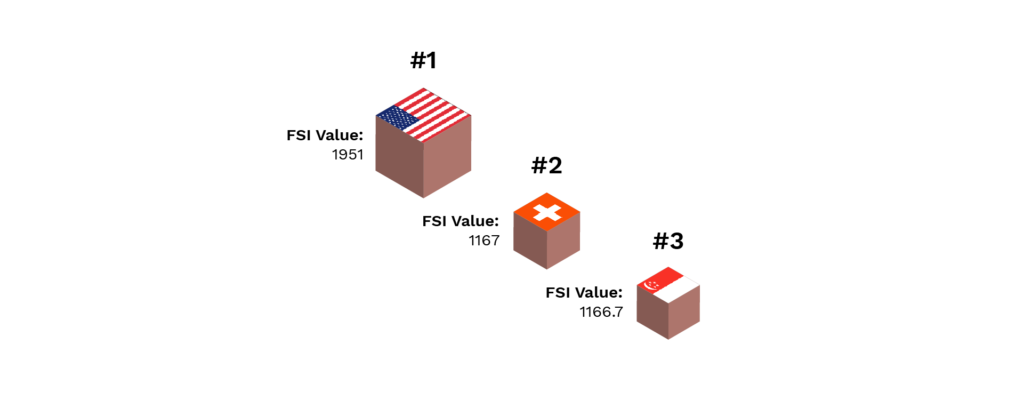

Jurisdictions are ranked by their FSI value (Financial Secrecy Index value), which is a measure of how much financial secrecy the jurisdiction supplies.

A jurisdiction’s FSI Value is calculated by combining its Secrecy Score and Global Scale Weight. A jurisdiction’s Secrecy Score is a measure of how much scope for financial secrecy its financial and legal systems enable, where a score of zero means the jurisdiction’s laws allow no scope for financial secrecy and a score of 100 means the jurisdiction allows unrestrained scope. A jurisdiction’s Global Scale Weight is a measure of how much in financial services the jurisdiction provides to residents of other countries, like opening a bank account or setting up a company. This is presented as a percentage of all financial services globally provided by all jurisdictions to non-residents.

Secrecy score

How much scope for financial secrecy the jurisdiction’s laws allow.

Global Scale Weight

How much financial services the jurisdiction supplies to residents of other countries.

FSI Value

How much financial secrecy the jurisdiction supplies, determined by combining the jurisdiction’s Secrecy Score and Global Scale Weight.

Combining a jurisdiction’s Secrecy Score and Global Scale Weight gives a picture of how much of the financial activity conducted offshore by individuals from around the world is put at risk of financial secrecy by the jurisdiction’s laws. Whereas tax haven blacklists usually only take laws into consideration and are often susceptible to political lobbying, the Financial Secrecy Index more accurately identifies harmful jurisdictions by taking into account how laws and offshore financial activity intersect in the real world to create financial secrecy risks.

A high or low Global Scale Weight is neither good nor bad, but the higher a jurisdiction’s Global Scale Weight is, the greater the responsibility the jurisdiction has to guard against financial secrecy – and conversely, the greater the risk for financial secrecy when the jurisdiction fails to uphold that responsibility.

This means a higher ranking does not necessarily always indicate a jurisdiction has more secretive finance laws, but rather that the jurisdiction’s laws and its popularity as a destination for offshore wealth combine to create a greater risk of financial secrecy.

Unlike tax haven blacklists which usually only factor in laws, the index more accurately captures how laws and financial activity intersect in the real world to create secrecy.

Panama is more secretive than the UK but the UK is used far more often as a destination for offshore wealth, making the UK a bigger supplier of secrecy in practice.

How jurisdiction’s Secrecy Scores are assessed

Each jurisdiction’s financial and legal systems are graded against 20 Secrecy Indicators to arrive at a final Secrecy Score, which is a measure of how much scope for financial secrecy the jurisdiction’s financial and legal systems allow. The jurisdiction’s final Secrecy Score is the average of the scores the jurisdiction receives for each indicator. A score of zero means the jurisdiction’s laws allow no scope for financial secrecy and a score of 100 means its laws allow unrestrained scope. Each jurisdiction’s Secrecy Score breakdown can be viewed in full detail on the index’s country profile page for the jurisdiction.

Secrecy Indicators cover a range of laws, policies and practices such as banking secrecy, anti-money laundering safeguards and registration of real estate owners. Indicators consist of several sub-indicators, making for more than 70 data points against which every jurisdiction is graded. For each data point, the Financial Secrecy Index provides evidence to explain the jurisdiction’s grading. These can be viewed in each jurisdiction’s Secrecy Score breakdown.

Secrecy Indicators fall into four categories: 1) Ownership registration, 2) Legal entity transparency, 3) Integrity of tax and financial regulation, and 4) International standards and cooperation.

A jurisdiction’s Secrecy Score is more than just a report card, it’s a troubleshooting manual that spots the laws and loopholes that policymakers can amend to tackle financial secrecy.

How Global Scale Weight is measured

A jurisdiction’s Global Scale Weight is a measure of how much in financial services the jurisdiction provides to residents of other countries, like opening a bank account or setting up a company. This is presented as a percentage of all financial services globally provided by all jurisdictions to non-residents.

The Financial Secrecy Index measures each jurisdiction’s Global Scale Weight by using data on exports of financial services provided by the International Monetary Fund’s Balance of Payments Statistics. Where this data is missing, estimates are extrapolated from related stock measures of cross-border financial assets. This is detailed in the index’s full methodology.

A high or low Global Scale Weight is neither good nor bad, but the higher a jurisdiction’s Global Scale Weight is, the greater the responsibility the jurisdiction has to guard against financial secrecy – and conversely, the greater the risk for financial secrecy when the jurisdiction fails to uphold that responsibility.

By taking a jurisdiction’s Global Scale Weight into account when assessing its role in enabling financial secrecy, the Financial Secrecy Index goes beyond “tax haven blacklists” by evaluating how much financial secrecy jurisdictions supply in practice, not just on paper. One way to think about it is a jurisdiction’s Secrecy Score is a measure of how efficient of a tool its financial and legal systems make for residents of other countries to hide their finances from the rule of law. And the jurisdiction’s Global Scale Weight is an indication of how frequently its financial and legal systems are used by residents of other countries as a tool. Combined together, the index identifies which jurisdictions serve as the most damaging tools in the toolbox for hiding finances from the rule of law.

For example, Anguilla, which was on the EU tax haven blacklist when the 2022 edition of the Financial Secrecy Index was published, received a Secrecy Score of 75. Meaning, the index found the jurisdiction’s financial and legal systems allowed a very high scope for financial secrecy. However, Anguilla had a Global Scale Weight of just 0.01 per cent, meaning Anguilla provided a very small fraction of the offshore financial services globally provided to non-residents. With Anguilla’s Secrecy Score and Global Scale Weight combined, Anguilla ranked 58th on the Financial Secrecy Index 2022. Although Anguilla’s financial and legal system were extremely harmful on paper, in practice the jurisdiction was not heavily used by individuals residing outside of the country and so was responsible for 0.59 per cent of the total financial secrecy risks measured by the index.

In comparison, the Netherlands, which is automatically excluded from the EU blacklist because it is an EU member, received a Secrecy Score of 65 on the Financial Secrecy Index 2021. A Secrecy Score of 65 is still high, but lower than Anguilla’s score of 76. The Netherlands, however, had a Global Scale Weight of 0.87 per cent. Meaning, the Netherlands provided 87 times as much in financial services to other countries’ residents as Anguilla did. Secrecy Score and Global Scale Weight combined, the Netherlands ranked 12th on the index and was responsible for 1.6 per cent of the total financial secrecy risks measured by the index. The Netherland’s financial and legal systems may have been less extreme than Anguilla’s on paper, but in practice the Netherland’s is far more heavily used by individuals residing outside of the country to hide their finances from the rule of law.

How Secrecy Score and Global Scale Weight are combined

Jurisdictions’ Secrecy Score (SS) and Global Scale Weight (GSW) are combined to determine the jurisdictions’ FSI Value (Financial Secrecy Index Value) via the following formula:

The rational used to combine Secrecy Scores with Global Scale Weights is led by the Financial Secrecy Index’s core objective of measuring a jurisdiction’s contribution to the global problem of financial secrecy while highlighting harmful regulations used in secrecy jurisdictions. By doing so, the Financial Secrecy Index contributes to and encourages research by collecting data and providing an analytical framework to show how jurisdictions facilitate financial secrecy. The index also contributes to public debates by encouraging and monitoring policy change globally towards financial transparency.

Disagreements with data or scoring

We believe we have applied our methodology consistently and transparently, disclosing the underlying, fully referenced and cross-checked data. Nonetheless, given the complexity and sensitivity of the work, we accept that disputes may arise.

We are committed to addressing any issues, and warmly welcome engagement. If you believe that our data or scoring contains errors, please contact us. The clearer and more detailed an explanation you are able to provide, the more easily we can consider the issue and respond accordingly.